401k calculator with over 50 catch up

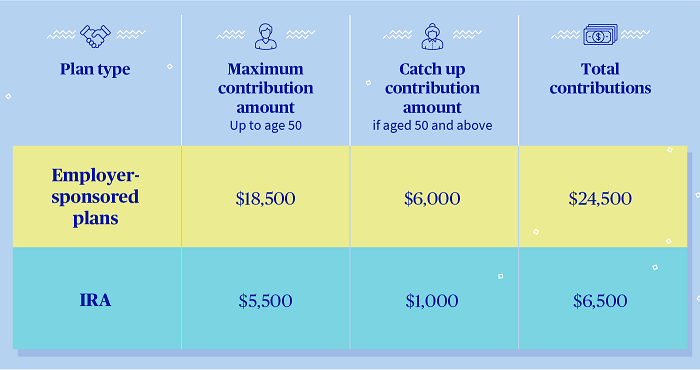

Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. The maximum catch-up contribution available is 6500 for 2022.

5 Reasons A 401 K Is Better Than A Simple Ira

For participants who are age 50 or older at the end of 2018 catch-up contribution limits for traditional or safe harbor 401 k is 6000 and SIMPLE 401 k is 3000.

. The annual elective deferral limit for a 401 k plan in 2022 is 20500. Remember you have until April 15 2021 to contribute the. CensiblyYours Custom Index Portfolios.

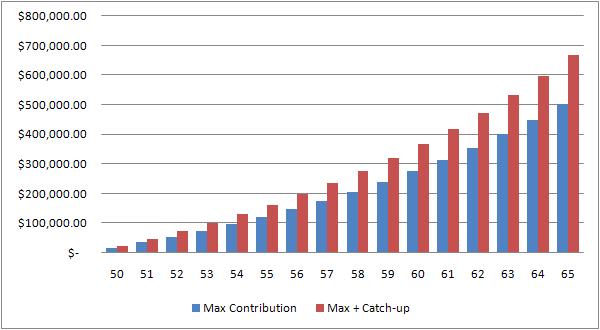

Here are the amounts limits and tips to boost retirement savings. Catch-up contributions allow people 50 and older to contribute more to 401k or IRA. That could really accelerate.

Are 401k Catch Up Contributions Increasing in 2022. A Retirement Calculator To Help You Plan For The Future. We show you top results so you can stop searching and start finding the answers you need.

That means including your catch up contribution your 2022 401k savings limit will be 27000. What is a 401k. SIMPLE Plan Catch-Up Amounts A SIMPLE IRA or a SIMPLE 401 k plan may permit annual catch-up contributions up to 3000 in 2015 - 2022.

10 Best Companies to Rollover Your 401K into a Gold IRA. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement.

You can use our. For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500. The maximum you can contribute to a 401 k is 20500 in 2022.

1 This is known as a catch-up contribution and it applies from the start of the year to. The maximum catch-up contribution available is 6500 for 2022. The catch-up contribution limit is 6500 in 2022 for people age 50 or older.

The plan is a calendar year plan. This is the percentage of your annual salary you contribute to your 401k plan each year. The 401k catch-up contribution limit remains the same in 2022 at 6500 for most plans and 3000 for SIMPLE 401ks.

Your annual 401k contribution is subject to maximum limits established by the IRS. There was a change in regulation. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. For those age 50 and older the 401 k catch-up contribution is 6500. The answer is NO.

Protect Yourself From Inflation. If youre 50 or older and need to catch up on your 401 k retirement savings the total amount youre able. For governmental 457b plans only.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up. If you are 50 years of age or older and are already contributing the maximum amount permitted by your plan you can contribute up to an additional 6000 annually. Sansa contributes 19500 max for anyone under age 50 in the first six months from.

If you are age 50 or over a catch-up provision allows you to. 2022 There is an alternative limit for governmental 457b participants who are in one of. If you are 50 or older you can make an additional 401 k contribution of 6500 a year.

The catch-up contribution limit for. Sansa will be age 50 on Dec. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains 1000.

401k Catch Up Contributions Retirement Catch Up Limits

How Much Should I Have Saved In My 401k By Age

How To Take Advantage Of 401 K Catch Up Contributions Wtop News

Best Retirement Calculator Retirement Calculator Retirement Income Saving For Retirement

Solo 401k Contribution Limits And Types

How Much Should I Have Saved In My 401k By Age

Rb5jm903cqmygm

How To Catch Up In Your Retirement Savings Plans Equitable

How Much Can I Contribute To My Self Employed 401k Plan

5 Reasons A 401 K Is Better Than A Simple Ira

Resources To Help You Manage Your 401k Independent 401k Advisors

How Much Should I Have In My 401 K At 50

5 Reasons A 401 K Is Better Than A Sep Ira

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Retirement Services 401 K Calculator

Advice And Tips On Saving For Retirement At Any Age Marketplace Org Money Saving Tips Budgeting Money Money Management